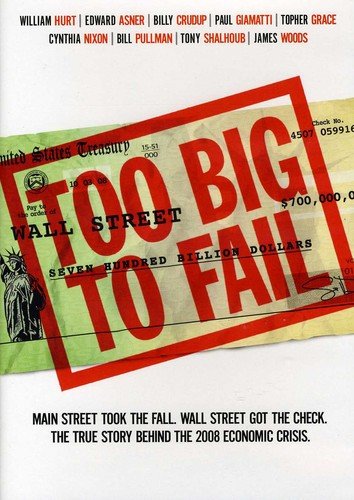

Hi there, Ronald Reagan. Hello as well to George Bush, Bill Clinton, G.W. Bush, and Barack Obama. Glad to meet ya. The newly-released DVD/Blu-ray/digital release of Too Big To Fail from HBO Home Entertainment opens with all four of their words of wisdom: “Deregulation of the banking industry is good for America.” Wow! is about all I can say about that.

Too Big To Fail falls into the winning category of HBO films such as Recount and The Late Shift. This time the focus is on the recent banking crisis, which has proven to be of major proportions. The film features an all-star cast, including James Woods, William Hurt, Paul Giamatti, Cynthia Nixon, and Topher Grace. Their performances are all outstanding. In fact, with the mix of actual news footage and pundit-talk, I began ignoring the fact that these are actors in a film, and actually believing that it is a documentary. Obviously it is not a documentary, yet the real-world scenarios laid out are too painfully true.

One of the greatest assets of the film is the way it shows the back-door manipulations between our government and the banking industry. For some reason, I previously thought of banks in the way George Bailey (Jimmy Stewart) was in It’s a Wonderful Life (1946). That is to say that while there may be the evil Mr. Potters (Lionel Barrymore) out there, the majority are fine, upstanding, moral business-people.

By showing Clinton and Obama giving high praise to the idea of de-regulation of the banking industry, Too Big To Fail artfully expresses the idea that it is not a political rant, which it easily could have wound up as. In the end, who’s too blame? As Reagan used to say; “Well…” and launch into an explanation that sounded good, but actually made no sense at all. I guess the old Gordon Gekko in Wall Street (1987) put it best with the immortal line, “Greed is good.“

What Too Big To Fail does best is show just how deeply our government is tied in with Wall Street. It seems that those bankers are the people who are really running the nation. The entire situation reminds me of the not-so-distant past during the first Bush presidency and the Savings and Loan crisis/bailout. I remember it getting an enormous amount of attention. The state of affairs has (in a lot of ways) been treated with kid gloves compared to the previous situation. It makes one wonder if our society is so self-absorbed that nobody really cares anymore. After all, what could possibly be more important than the latest 4-G phone, or iPad?

Watching this film opened my eyes to how closely we as a nation faced a total financial meltdown. It is a particularly galling fact that executives from banks who had to receive a financial bailout to stay afloat actually received huge bonus checks that year.

While Too Big To Fail is (by necessity) a “political” film, I don’t believe that the producers have chosen sides with it. The poor choices made by our government over the past three decades proves that the “greed is good“ credo applies equally to Democrats and Republicans. As “Deep Throat” said in All the President’s Men (1976), “Follow the money.” Following the money at this stage of the game is pretty tough though. The financial meltdown was almost a perfect storm of bad decisions.

Besides the outstanding performances of all involved, and the truth is stranger than fiction premise, Too Big To Fail lays out some truly alarming facts. We are now down to 10 banks controlling the wealth of the nation, with no end in sight right now. I think that Republicans and Democrats can both agree that another monetary disaster is something to be avoided at all costs. The greed on Wall Street will never leave, but obviously something has to change.

Too Big To Fail comes in a nice package, with a Blu-ray copy, a standard DVD, and a code for a digital download. It will be released June 12, and I strongly suggest it. This film is everything it promises and more. The movie is thought provoking to be certain, and highly entertaining as well.